The Complete Guide to

JD Edwards Financial Best Practices

Table of Contents

Intercompany in EnterpriseOne

In an increasing international market place, Intercompany Transactions, and particularly Multi-Currency Intercompany Transactions, are being used more and more. It is to JD Edwards’ credit that, once the setup is completed correctly, the process is stable and consistent. Although the setup is complex, it is quite understandable once you know how all of the parts fit together.

For our working example, we have an international corporation with several companies in the United States and several in Canada set up in EnterpriseOne (E1). They want all of the US companies to be able to create Intercompany Transactions among themselves but not with the Canadian companies and vice versa. They did not want to have a specified Hub Company, a single Company through which all Intercompany Transactions are written and which limits the directional flow of the Intercompany Transactions. They wanted to allow any of the Companies within the group to trade with any other “Member Company”, as Oracle refers to them.

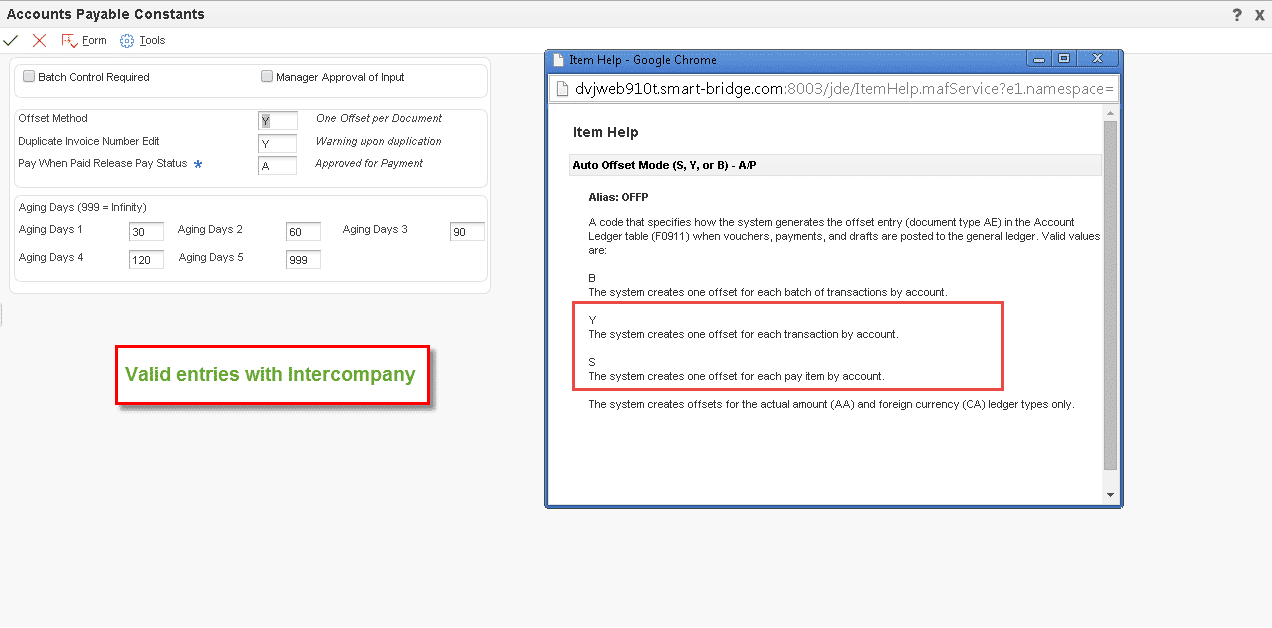

- Accounts Payable Constants (jump to section)

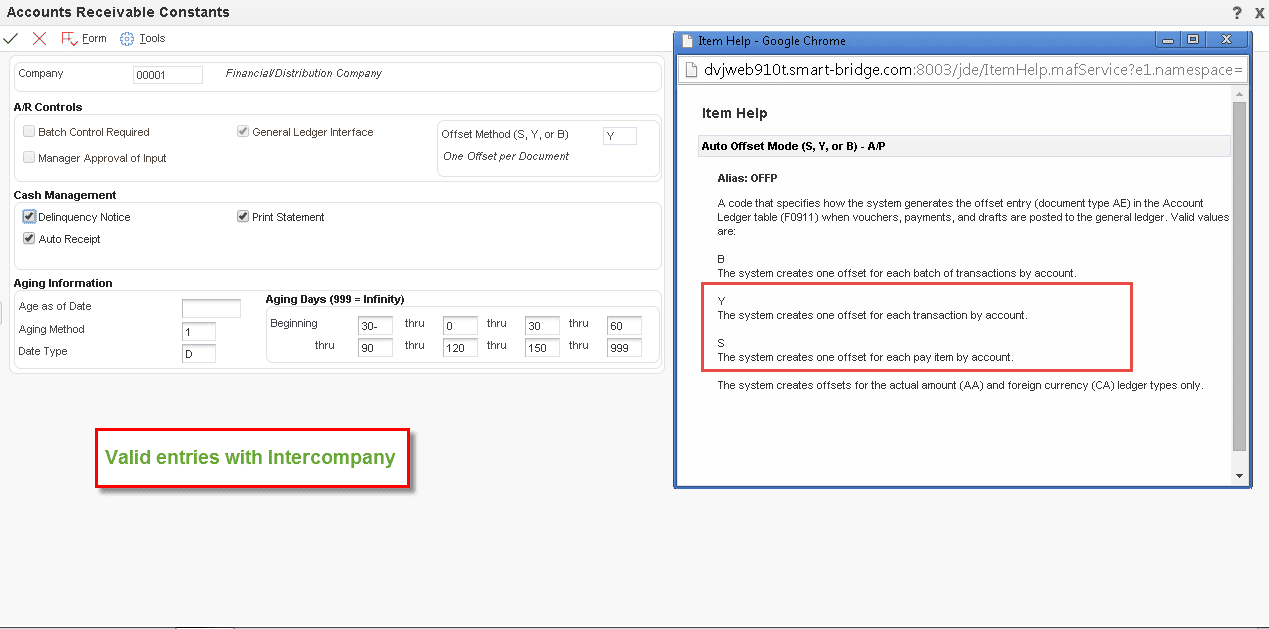

- Accounts Receivable Constants (jump to section)

However, the very first step is to define how the business process is to work.

Are Intercompany Transactions going to be posted in detail?

If transactions are posted in detail, the number of transactions increases in your General Ledger Detail table (F0911). However, summarized transactions are much more difficult to trouble shoot if a transaction “goes astray”.

Is there to be Hub Company?

In other words, all transactions must go through the Hub Company. If there is no defined Hub Company, any of the Member Companies can initiate an Intercompany Transaction with any other Member Company.

Are there to be restrictions on which companies can trade with one another?

In our example, there are two configured groups. One group has Canadian dollars as their base currency in all of the companies in the group. The other group has United States dollars as their base currency. It was determined that there was not to be trading between the two groups and that there was no defined Hub Company in either group.

Company Constants

There are two fields in the Company Constants applicable that pertain to the Intercompany Transactions setup:

- Intercompany Settlements

- Allow Multi-Currency Intercompany Transactions Check Box

The figure below is the Company Constants screen with the two fields enclosed in the red rectangle and the Help text for the Intercompany Settlements field superimposed on the screen.

INTERCOMPANY SETTLEMENTS

There is a lot of power in the value entered in this one little field. We will discuss here not only how they impact the system but also how these other settings impact the setup of the other two applications.

OPTION 1. This is used for non-configured Intercompany with a Hub.

- AAI – requires that there be an ICCC entry in the AAI for each Company in the Company Master. The ICH entry for the designated Hub Company is entered for Company 00000 with the Business Unit defining the designated Hub Company.

- Configuration Master – no entry is necessary

OPTION 2. This is used for the Detail Method of Intercompany without a Hub. This can be used for either Configured or Non-Configured Intercompany Transactions. However, if this is used with the Configuration Master, it will not restrict the Intercompany Transactions to the group in which they are defined.

- AAI – requires that there be an ICCC entry in the AAI for each Company in the Company Master. No ICH entry is needed.

- Configuration Master – optional setup

OPTION 3. This is used for Configured Intercompany Transactions with or without a Hub. So, two possible setups are defined below.

Configured with a Hub

- AAI – requires that there be an ICCC entry in the AAI for each Company in the Company Master. No ICH entry is needed. The Hub is defined within the group in the Configuration Master.

- Configuration Master – Each of the groups has a designated Hub Company.

Configured without a Hub

- AAI – requires that there be an ICCC entry in the AAI for each Company in the Company Master. No ICH entry is required. See Option Two above

- Configuration Master – All of the Companies in each of the groups are Members.

Creating a Chart of Accounts

What is a Chart of Accounts?

A chart of accounts provides the structure for your General Ledger accounts. It lists specific types of accounts, describes each account, and includes account numbers. A chart of accounts typically lists asset accounts first, followed by liability and capital accounts, and then by revenue and expense accounts.

An account is a title that defines the types of transactions that are contained within it. The Open Accounts Receivable Trade Account is where all of the unpaid Accounts Receivable transactions reside. Once they are paid, the same transactions are then recorded as Revenue and Cash.

Designing the Chart of Accounts

To design your chart of accounts:

- Begin your initial design with the major headings of your transactions.

- Then add your detailed transaction descriptions.

A Chart of Accounts is generally divided into major groups of accounts. The grossest groupings are the Balance Sheet and the Income Statement or Profit and Loss Statement. The most common structure of a Chart of Accounts follows these major groups. The Balance Sheet always precedes the Income Statement, especially in JDE. Within those major groupings, there are more groups, each defining the amounts into more detailed groups.

Setting the Chart of Accounts up in JDE

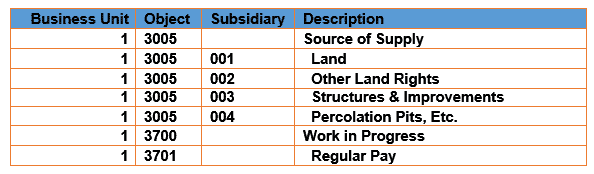

The Account Structure in JDE is Business Unit, period, Object Account, period, Subsidiary Account.

- Business Units describe where in your organization the transaction will have an impact. It represents the lowest organizational level within your business where you record all revenues, expenses, assets, liabilities, and equities. Business units typically represent a location, department, work center, or job, etc.

- The Object Account is the type of monies. It could be Cash or Open Accounts Receivable or Transistor Sales. It will be used as the description of the transaction. It is strongly recommended that the same numbering and description be consistent for all companies and business units for consolidation roll ups. More on that later…

- The Subsidiary Account is the optional part of the Account Number. It is used in the General Ledger as a further breakdown of the Object Account; Cash as the Object with a subsidiary dividing up the different bank accounts, for example, Cash in Bank of America. In Job Costing, the Subsidiary is used to define the Phase of a Job and that discussion is out of the scope of this document.

Here is a portion of a well-defined Balance Sheet.

In JDE there are two other fields that can be used to further define the account: Alternate Account and Subledger.

- Alternate Object.Subsidiary (obj.sub) can be used to comply with a regulatory chart of accounts, parent company requirements, a third-party coding scheme, or as the account number from a prior system used as a cross reference.

- Subledgers – Another further division of data. Subledger values must be defined to the system as the values used in the subledger are validated by type. If the subledger is an Address Book Number, that Address Book Number must exist in the Address Book Master before it can be used. There is a unique system-assigned Short Account ID assigned to each unique combination of Business Unit, Object, and Subsidiary. Balances are stored by this unique key. However, subledgers are an additional field which equates to an additional balance.

There are two more very important fields in the JDE Chart of Accounts: Posting Edit Codes and Levels of Detail.

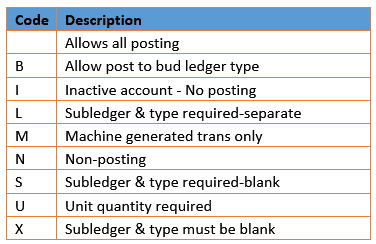

POSTING EDIT CODES (PEC)

Posting Edit Codes are used to indicate the different usages of the accounts for functions such as headings, accounts reserved for budgeting only or system-generated amounts only.

Assign a posting edit code to every object or object.subsidiary account in the chart of accounts. This code determines whether the account posts to the General Ledger and whether it updates the Account Balances table (F0902).

Valid Posting Edit Codes and their purpose are defined in this table:

LEVELS OF DETAIL

Levels of Detail are JDE’s way of allowing great flexibility across any different types of corporations all over the world without requiring to have the same COA. That way your COA matches the needs of your company rather than the COA that JDE dictates you use. Level of Detail is used to summarize and classify accounts in the General Ledger.

Changing a Chart of Accounts

We just showed you how to make a Chart of Accounts, however, most of us are not lucky enough to be able to design our own Chart of Accounts (COA) from scratch. When we signed on to the company that we’re working for that has JDE, we also inherited a COA. Unfortunately, it’s not always the best designed for the way the company is currently doing business.

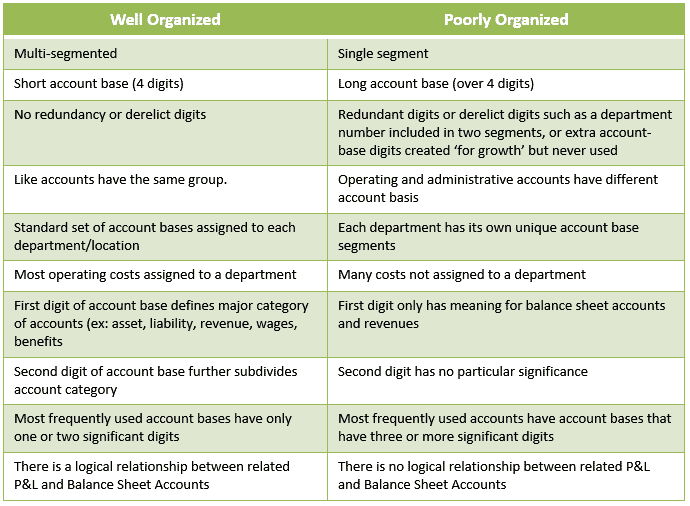

When working with a COA we didn’t design, we need to find any symptoms of it being poorly designed:

So, what do we do with the Chart that we have? Throw it out and start over? That is a massive project!

Particularly in a system like JDE that is interconnected to many different sub-ledgers that, like it or not, contain information that ties all transactions that impact the bottom line back to the General Ledger whose backbone is, of course, the Chart of Accounts.

Designing Your New Chart of Accounts

The best way to arrive at your destination with the least amount of trauma, is to have a clear vision of your target. To design your chart of accounts follow these steps:

- To use JDE most effectively, follow the COA Design Requirements (see resources below.)

- Begin your initial design with the major headings of your transactions

- Then add your detailed transaction descriptions

Standard JDE Functionality Assumptions

A Chart of Accounts is generally divided into major groups of accounts. The grossest grouping are the Balance Sheet and the Income Statement or Profit and Loss Statement. The Balance Sheet always precedes the Income Statement especially in JDE. As previously stated, the most common structure of a Chart of Accounts follows the groups: the Balance Sheet and the Income Statement.

Requirements

Recommendations

- Set up both a Model Company and a Model Business Unit

- Set up the Model Chart of Accounts within that Model Company and Business Unit

- Models can be specific to a particular type of business (Water, Energy, Construction)

- This will insure consistency across all Business Units of the same type

- Keep the Model current to business needs

- Provides reporting flexibility without changing the Chart of Accounts

- Record Category Code usage in the Model and in documentation available to personnel that will be responsible for maintenance of the COA

- Balance Sheet

- Income Statement

- Trial Balance

- Company Consolidations (if applicable)

Beginning the Change to Chart of Accounts

The Model COA has been designed and tested and it’s living up to the expectations that you have for the way that a Chart should perform. You’ve gotten the Category Codes set up to do Alternate Reporting, should you need to. You’ve copied the Production environment to a test environment. Now we’re ready to begin the process of changing old Accounts to new Account Numbers in the test environment first.

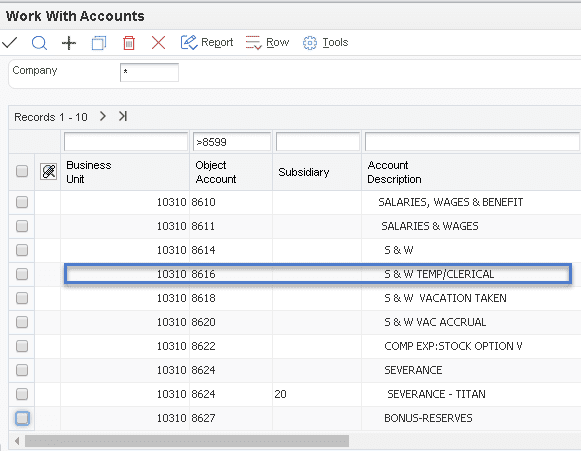

The Short Account ID in the Master Chart table, F0901, is now instrumental. In the sub-ledgers where the General Ledger Accounts has been stored, it is stored as the Short Account ID (AID, or in some tables as GLBA). Therefore, if the Short Account ID remains intact in the record in the COA Master as the Business Unit, Object, and Subsidiary Accounts are changed, the historical information will remain accurate and Integrity Reports will remain constant.

The following topics are covered in detail in our video tutorial:

Final Steps

Updating the Detail and Balance Tables

Regardless of which segment of the General Ledger Account number you have changed, Business Unit, Object Account, or Subsidiary, the final steps that need to be taken are to update the General Ledger Balance table, F0902, and the General Ledger Detail table, F0911.

To do this, you run the Update Business Unit.Object.Subsidiary to Journal Entry program (R09806). This program compares the Business Unit, Object, and Subsidiary for each Short Account ID in the F0911 and F0902 tables to the Account Master records in the F0901 table and updates the F0911 and F0902 tables, based on the F0901 table.

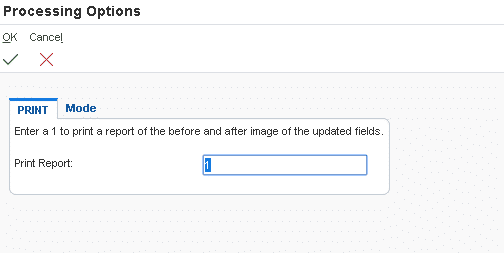

R09806 Processing Options

Integrity Reports to Verify Changes

After you run the Update Business Unit.Object.Subsidiary to Journal Entry program, complete these tasks:

If you created a new business unit, you can revise old Business Unit information. You can change the old Business Unit to be inactive or delete it. You might also want to enter the new Business Unit number of the old Business Unit as a cross-reference. You can do this in the Project Number field on the Revise Business Units – More Detail tab.

Changing the Fiscal Year

During either an acquisition or a merger one of the issues is the determination of the Fiscal Year and the consolidation of Financial Reporting. If one of the participants in the acquisition/merger has a stated Fiscal Year different than the one used moving forward, that organization must change their existing Fiscal Year to coincide with the one used by the new corporate structure.

For our working example, we have a corporation with several companies in the United States operating with a Fiscal Year of October 1st through September 30th. The acquiring Japanese firm had a Fiscal Year equal to the Calendar Year. The US firm was officially acquired and registered with the SEC as closing on January 12, 2015 and becoming a part of the Japanese firm as of January 13, 2015.

The following process we’re discussing was actually run in a partial manner to change the previous Period End Date for Period Three (December) to be January 12, 2015 instead of December 31, 2014 and Period Four (January) to be January 13, 2015 through January 31, 2015.

The second step in the process, after adjusting entries were posted and balances were approved by both corporations and the SEC, was taken to change the Fiscal Year officially to be January first through December 31st.

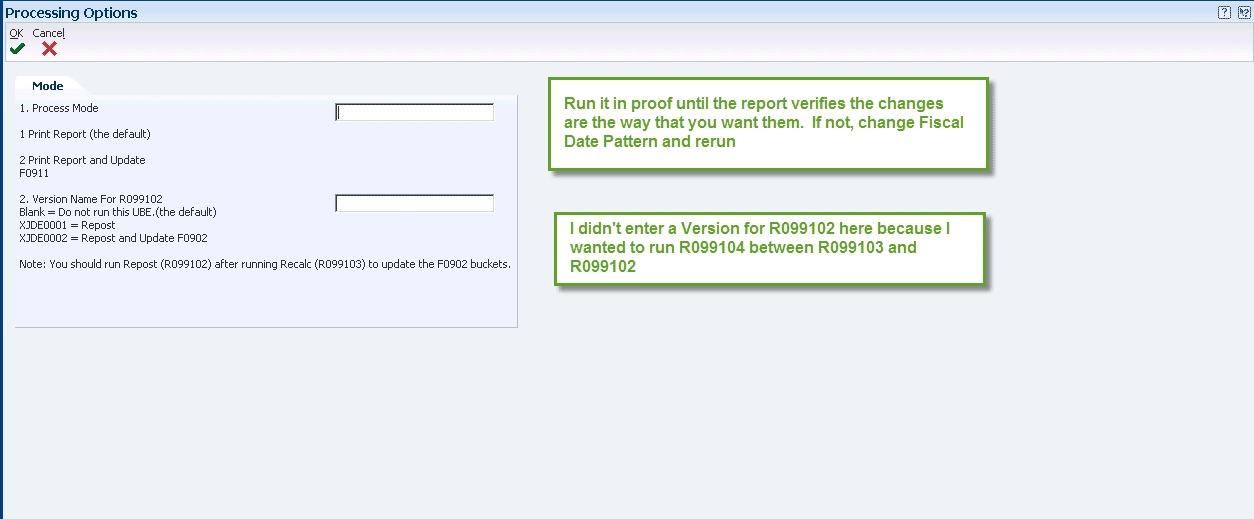

There are three main applications that are used to set up Intercompany Transactions in E1; R099102, R099103, and R099104. Our example has been set up in Release 9.0 with Tools Release 8.98. If you are using the Fixed Asset module, you might also use the Fixed Asset Repost, R12910. We’ll discuss when the Fixed Asset Repost will not work and what must be done instead later in this article.

Fiscal Date Pattern (F0008)

First, determine:

- What is the current Fiscal Year schedule?

- What is the Fiscal Year Code used in the Company Master?

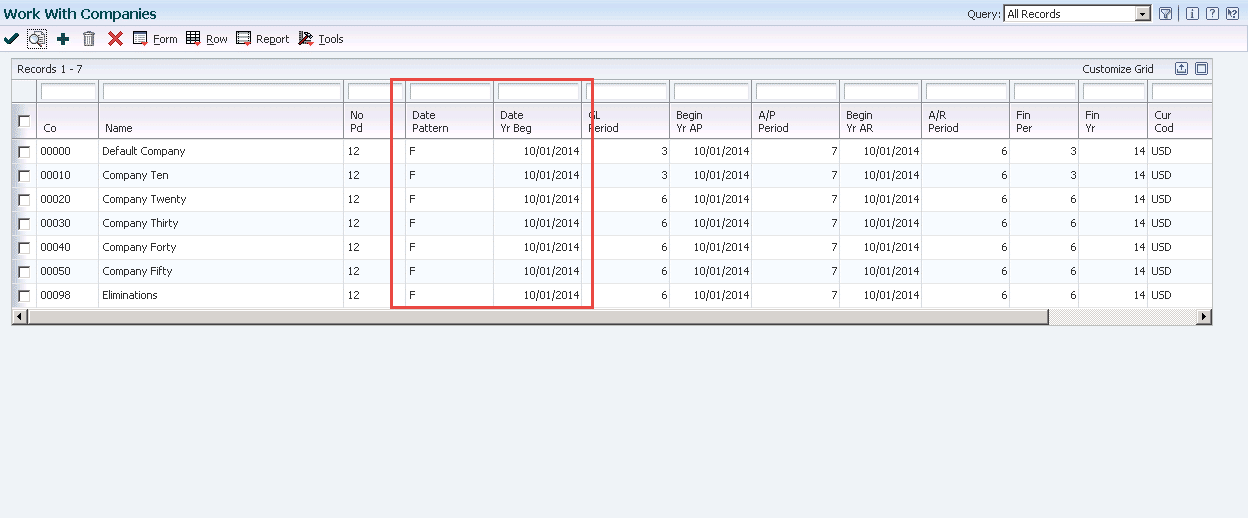

This can be done by looking at the Company Master (F0010) and obtaining the Fiscal Date Pattern Code. In our working example the Fiscal Date Pattern was F.

(Click on the images to enlarge them.)

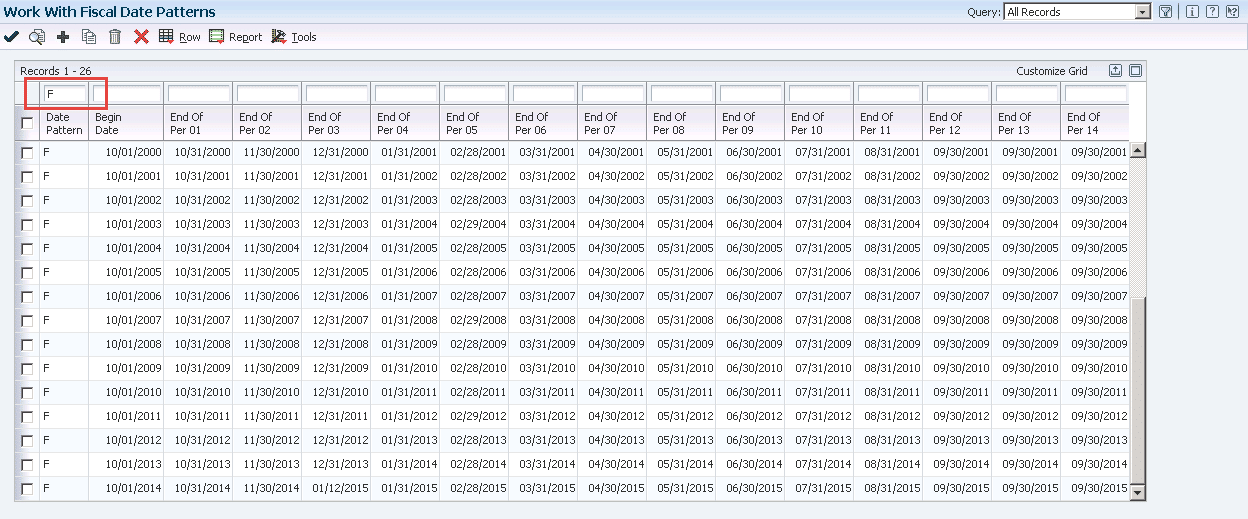

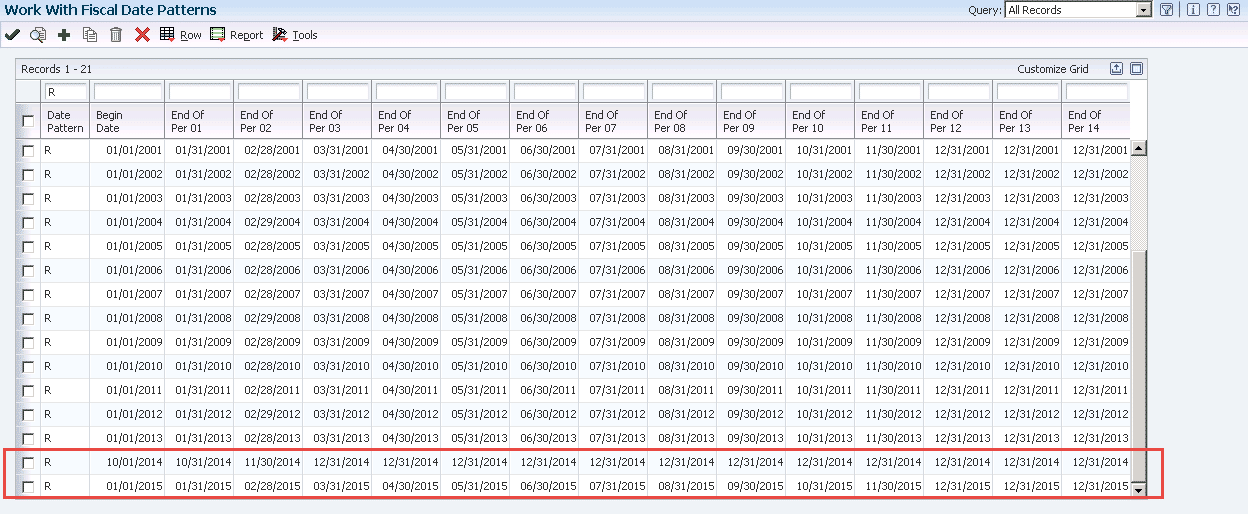

Use the Form menu to access the Fiscal Date Pattern and, if necessary, to set up the Fiscal Date Pattern to that which you’ll be using going forward. In our case it was Fiscal Date Pattern R which someone had almost totally set up for us. Especially if you are using the Fixed Assets module, you must ensure that all of the years for the lives of the Assets have been set up – past and future.

The exception in the Fiscal Date Pattern will be with the current year, in our case, 2014. We set up the Fiscal Date Pattern for 2014 to start on October 1, 2014 and end on December 31, 2014. Fiscal Year 2015 began on January 1, 2015. Future years defined follow the new Date Pattern. See below.

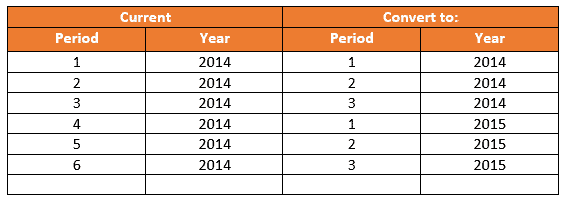

Current:

For Conversion of the Fiscal Year:

As you can see in the screen below, our Fiscal Year 2014 begins in October 1, 2014 and has only three periods. If, for example, our Fiscal Year had begun in June 2014, our “Conversion Fiscal Year” would have the periods from June 2014 through December 2014.

Change the Company Master(s) to have the new Fiscal Date Pattern

R099103 – Changing the Period Numbers in General Ledger Detail (F0911)

Now that the Company Masters are set up the way that we want, we need to make the data in the General Ledger detail match the newly created periods. Therefore, the records that have periods one through three in them, will not change. They are correct as they are. However, starting in period four, they now should be in period one for Fiscal Year 2015.

Here is a table that I hope makes this clear:

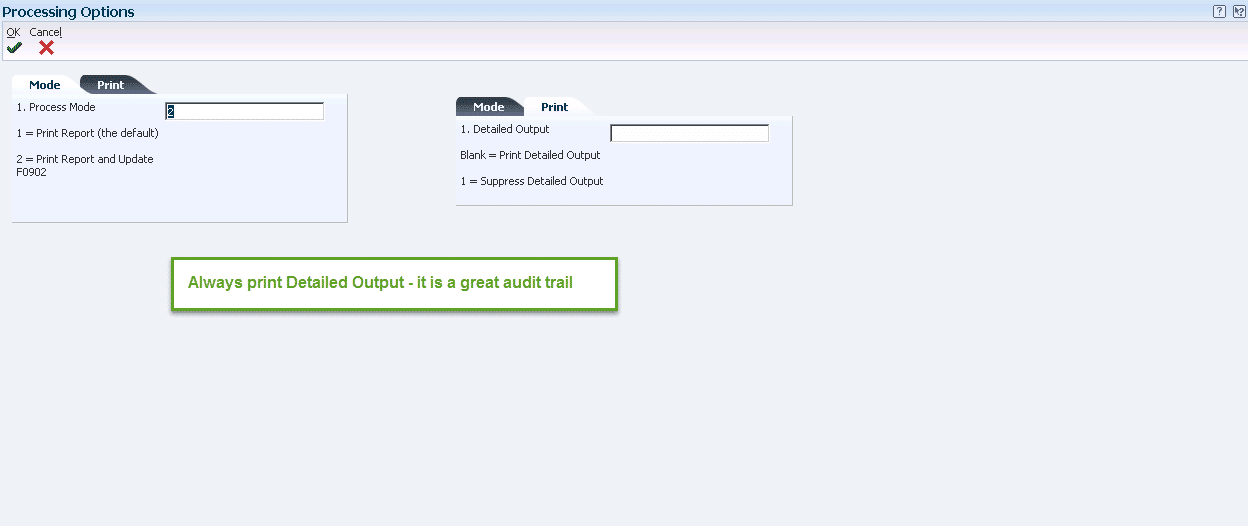

Processing Options

Here are the processing options for R099103. I ran this in proof mode, checking the report between each run until I was satisfied that the transactions were going to be moved to the periods the way that I wanted. If the Version field for R099102 is left blank, it isn’t submitted to run after this is finished giving you more flexibility to do any needed processes, like running R099104 to clear the Account Balances.

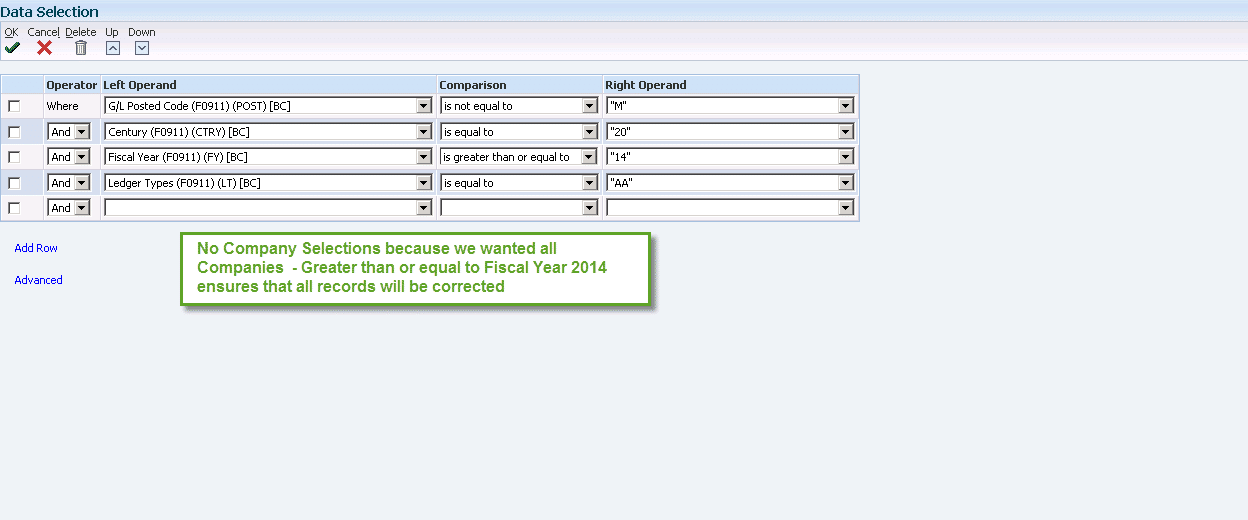

Data Selections

R099104 – Clearing the Account Balances (F0902)

The Recalculation Report now looks the way that we want it to and we’ve run it in Final Mode. The next step is to clear the Period buckets in the General Ledger Balances table.

Processing Options

No processing options.

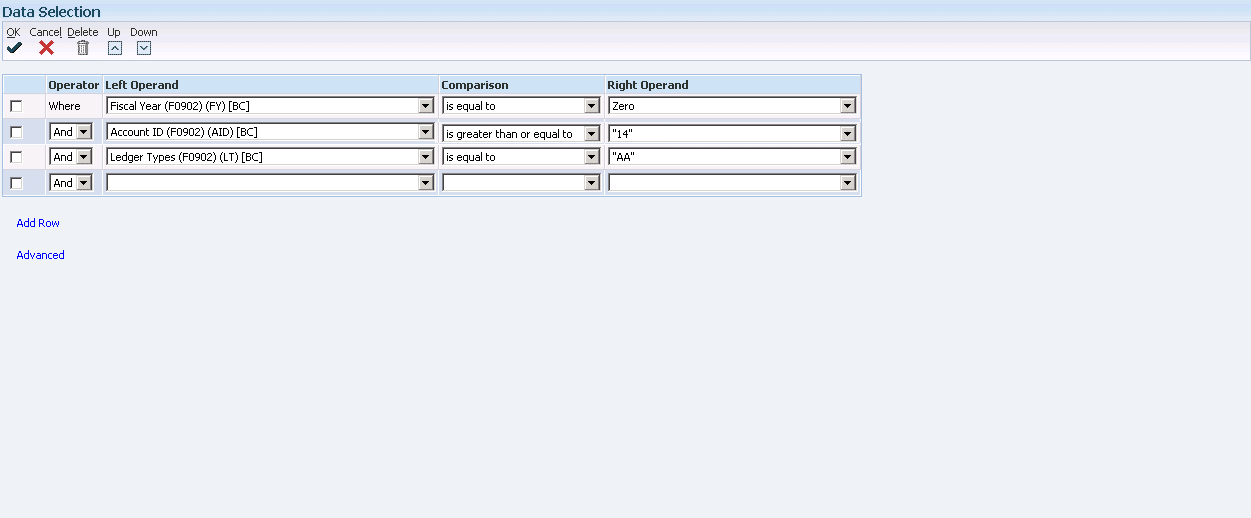

Data Selections

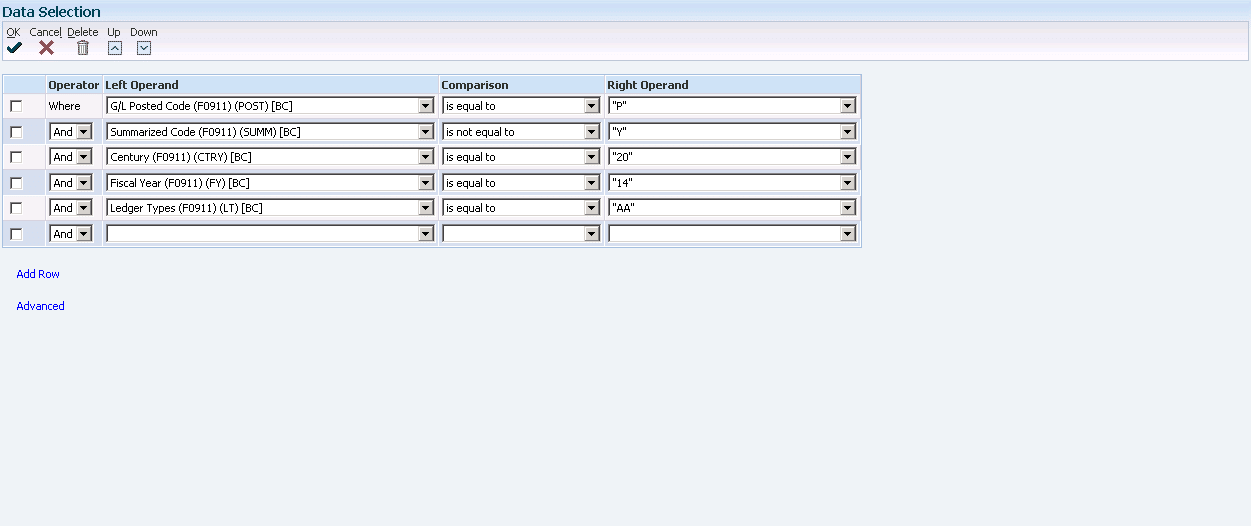

R099201 – General Ledger Repost

The General Ledger Repost is a treasure. It will always take the data that is in the General Ledger detail and post it to the Period and Fiscal Year that is in the record by Short Account ID. The General Ledger detail is the Truth of what is posted in your system.

Processing Options

Data Selections

You may wish to make the Data Selection for Fiscal Year greater or equal to the current year. Both need to be reposted. Or you may do them in separate steps, Reposting the new Fiscal Year after the Annual Close for the current year.

R12910 – Fixed Asset Repost (F1202)

*** Only run this if the Depreciation Calculations have never been summarized ***

If this sounds like the voice of experience, it is. This functionality is only available to you if the Depreciation Calculations (R12855) has never been run with a ‘1’ in Processing Option Number Four on the Processing tab. This is so important I’ve created an Appendix at the end of this article that discusses the alternative if Depreciation has been summarized.

So, assuming it has not been summarized, zero out the balances in the Fixed Asset Balance table, and run the Repost.

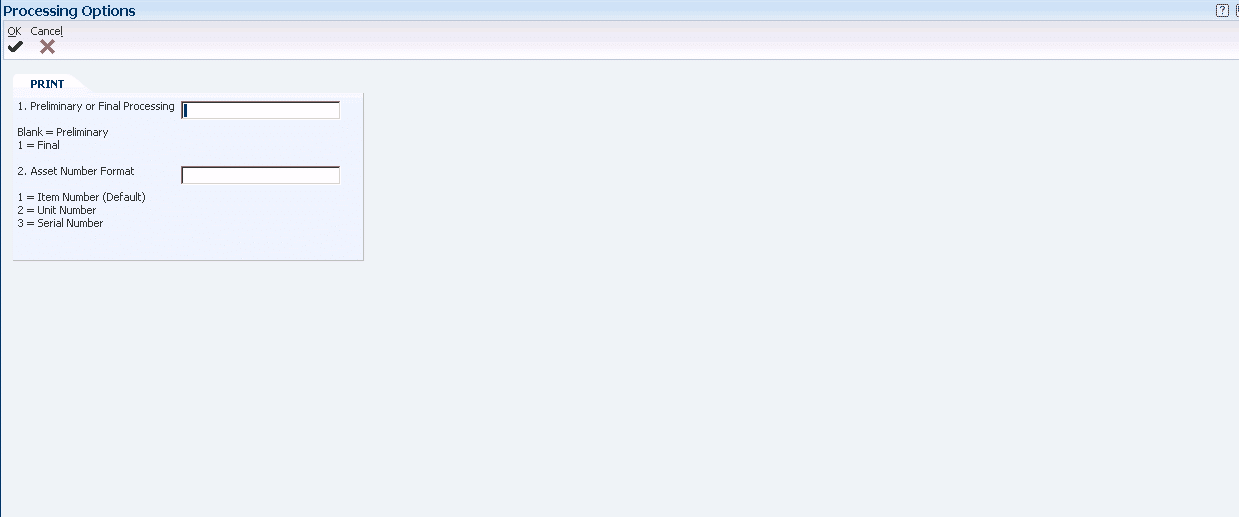

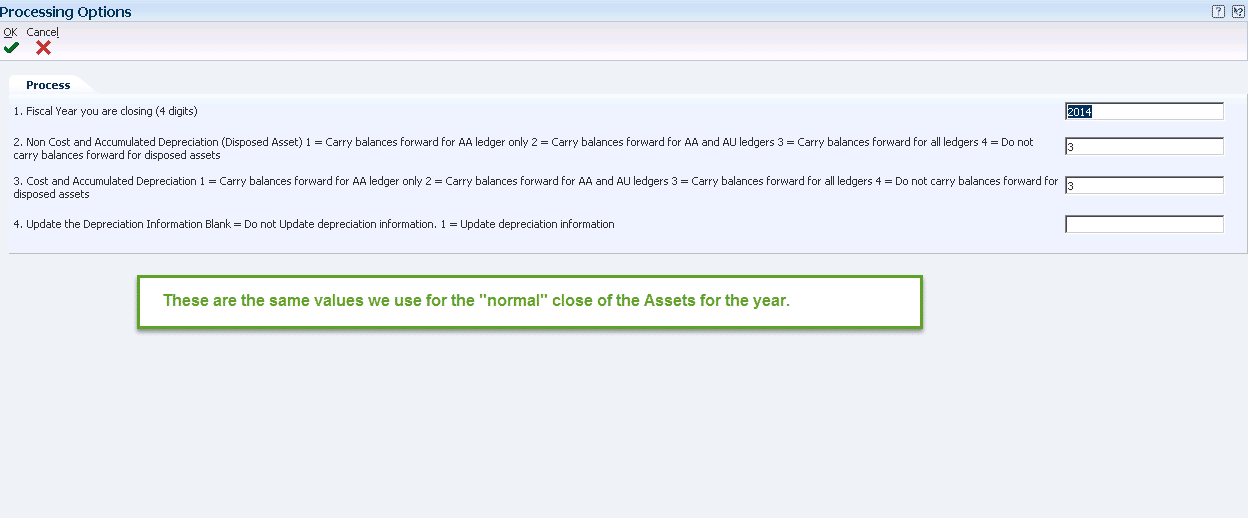

Processing Options

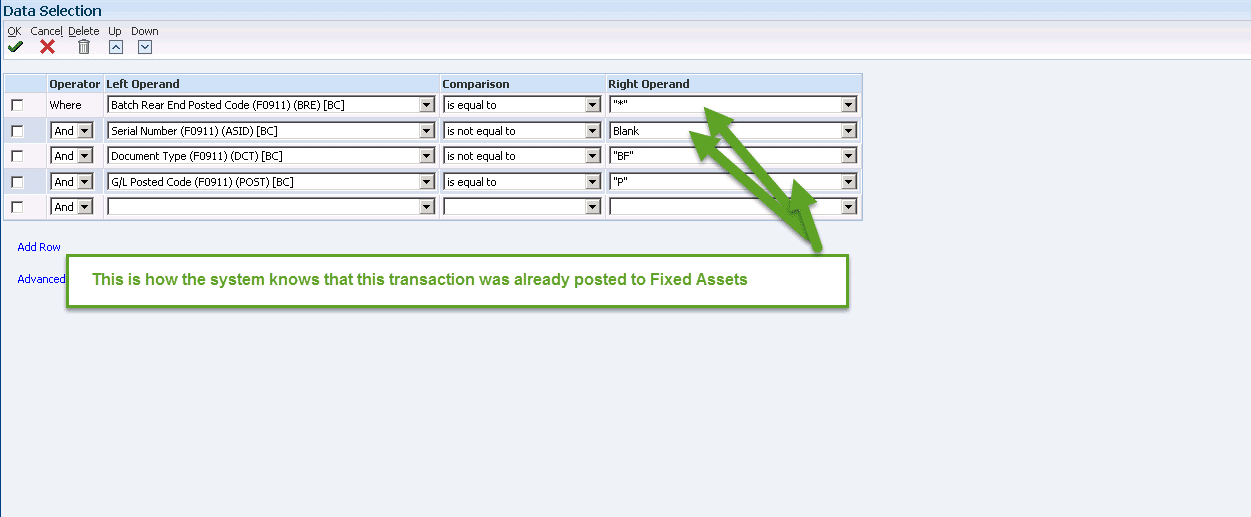

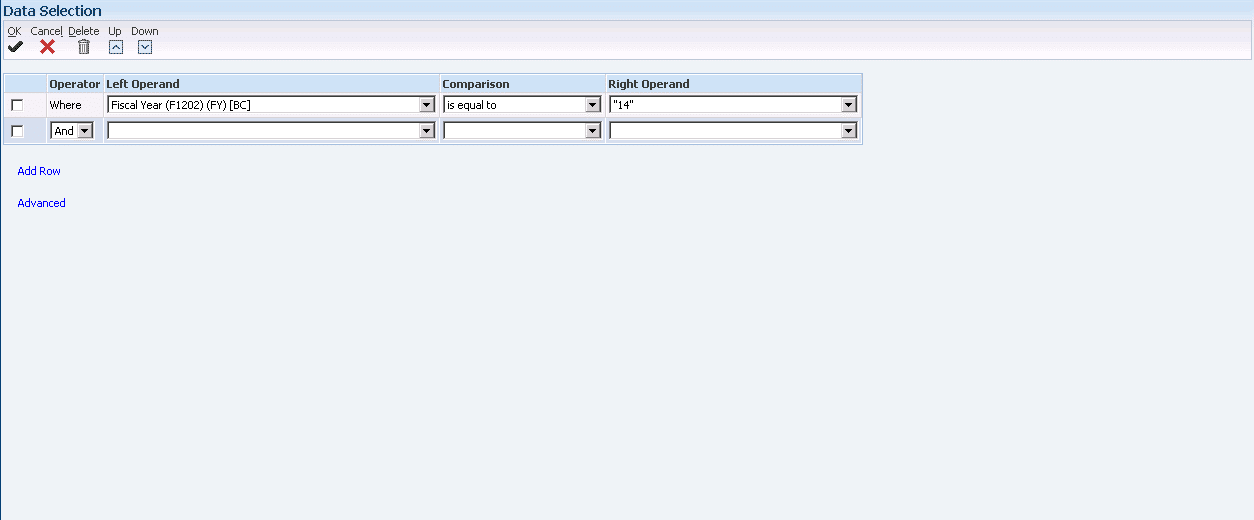

Data Selections

You may wish to make the Data Selection for Fiscal Year greater or equal to the current year. Both need to be reposted. Or you may do them in separate steps, Reposting the new Fiscal Year after the Annual Close for the current year.

R098201 – General Ledger Annual Close

Since we have effectively changed the end of the year balances for the current year, 2014 in our example, we must close Fiscal Year 2014 and create beginning balances for 2015.

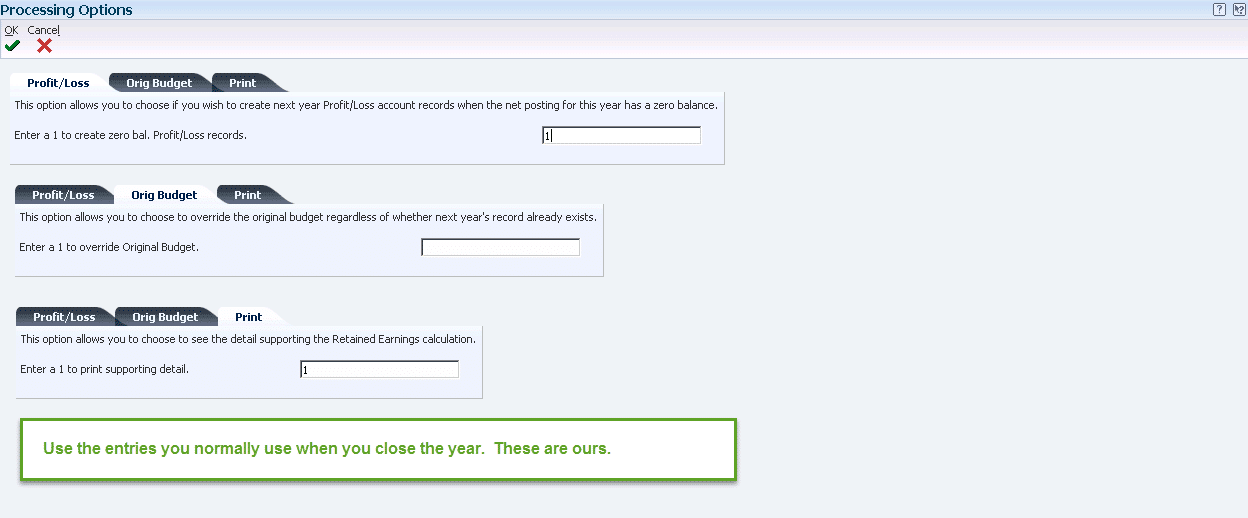

Processing Options

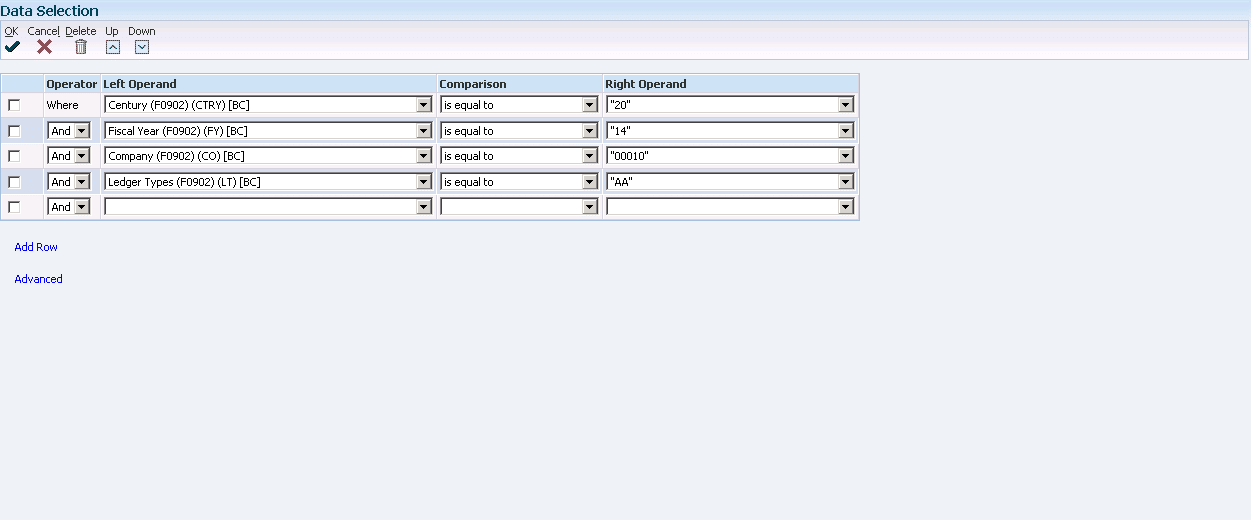

Data Selections

We removed the Company Selection line since we were closing all Companies.

R12825 – Fixed Asset Account Balance Close

Regardless of whether you followed the process defined in Appendix A or the Fixed Assets Repost, you must now close the Fiscal Year for Fixed Assets as well.

Processing Options

Data Selections

Additional Resources:

Reposting the Account Ledger and Recalculating the Fiscal Year (docs.Oracle.com)

E1: 09: How To Change Date Patterns and End Dates In EnterpriseOne (P0008, P0010, R099103) (Doc ID 664748.1)

Appendix A

If the Depreciation Calculations were ever Summarized, the method of dealing with the change of the Fiscal Year for Fixed Assets must be done manually. This is due to the fact that the amount of the Depreciation Calculations is in the General Ledger as a lump sum by account but in the Fixed Assets Balance table, F1202, the amount has been Posted by Asset. If a Fixed Asset Repost is done, it will wipe out the Asset Balances in F1202.

The steps taken are as follows:

- Copy Current Year Balances to another F1202x

- Copy Current Year Balances to another F1202y

- Delete Current Year Balances from F1202

- In F1202x, Clear Buckets for “lap over” Periods

- In F1202y:

- Change Fiscal Year to Next Fiscal Year

- Move Period Amounts to Correct Buckets

- Copy F1202x and F1202y back into F1202

Here is an example based on our dates:

Fixed Assets (all Ledger Type AA)

- Copy Current Year Balances to F1202_14

- Copy Current Year Balances to F1202_15

- Delete 2014 from F1202

- In F1202_14, Clear Buckets for Periods 4 – 6

- In F1202_15

- Change Fiscal Year to 15

- Move Period Amounts

- Period Four to One

- Period Five to Two

- Period Six to Three

- Clear Buckets for Periods 4 – 6

- Copy F1202_14 and F1202_15 back into F1202

Keep Reading: How to Automate the JD Edwards Item Master Load

Looking for more on JD Edwards?

Explore more insights and expertise at smartbridge.com/jdedwards

There’s more to explore at Smartbridge.com!

Sign up to be notified when we publish articles, news, videos and more!

Other ways to

follow us: