The 5 Step Revenue Recognition Model

Effective and efficient revenue recognition processes serve as the foundation for accurate and ethical accounting principles. For a company providing products, services and/or contractual commitments of any kind, when and how to recognize revenue from delivering those commitments is extremely important. In this article, Smartbridge CEO Sri Raju dives into the dynamics of revenue recognition in the food service industry, and how innovative digital practices make the process more efficient.

Accurate and Ethical Financial Performance Tracking

Many of us remember the October, 2001 Enron Corporation scandal that led to the bankruptcy and downfall of the entire organization, along with its auditors Arthur Andersen. An energy industry giant that once influenced many through their innovation in energy solutions, and community involvement, was now publicly tainted with numerous negative connotations. Though many aspects of fraud and unethical business practices were evident in this scandal, premature and unlawful recognition of revenue from their contacts with their business partners was one of the more apparent issues that inflated their revenues.

Why is Revenue Recognition Important?

Revenue recognition is a generally accepted accounting principle (GAAP) that establishes the terms of when revenue is earned, and when it can be recorded. For the party providing the products or services, revenue can be recorded when contractual commitments have been fulfilled, whether or not cash has been received. However, if the commitments specified have not been fulfilled, revenue has not necessarily been earned, and therefore cannot be recorded.

The purpose for this principle is to ensure commitments are carried out entirely, ethical practices are being established, and systematic accounting methods are in place for shareholders to trust.

By recognizing revenue when contractual agreements were made, and not fulfilled, Enron’s revenue was reported with massive increases, which was not only grossly incorrect, but unethical.

In January of 2018, a new revenue recognition standard was put into effect through a collaborative implementation by the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB). This new standard effectively replaced all previous revenue recognition standards industry wide (with the exception of insurance and lease vendors), which stated revenue can only be recognized at the time the invoice was posted. There were multiple reasons for this new standard to occur:

By providing an inclusive principal to revenue recognition, this standardization would significantly minimize unethical and incorrect accounting methods.

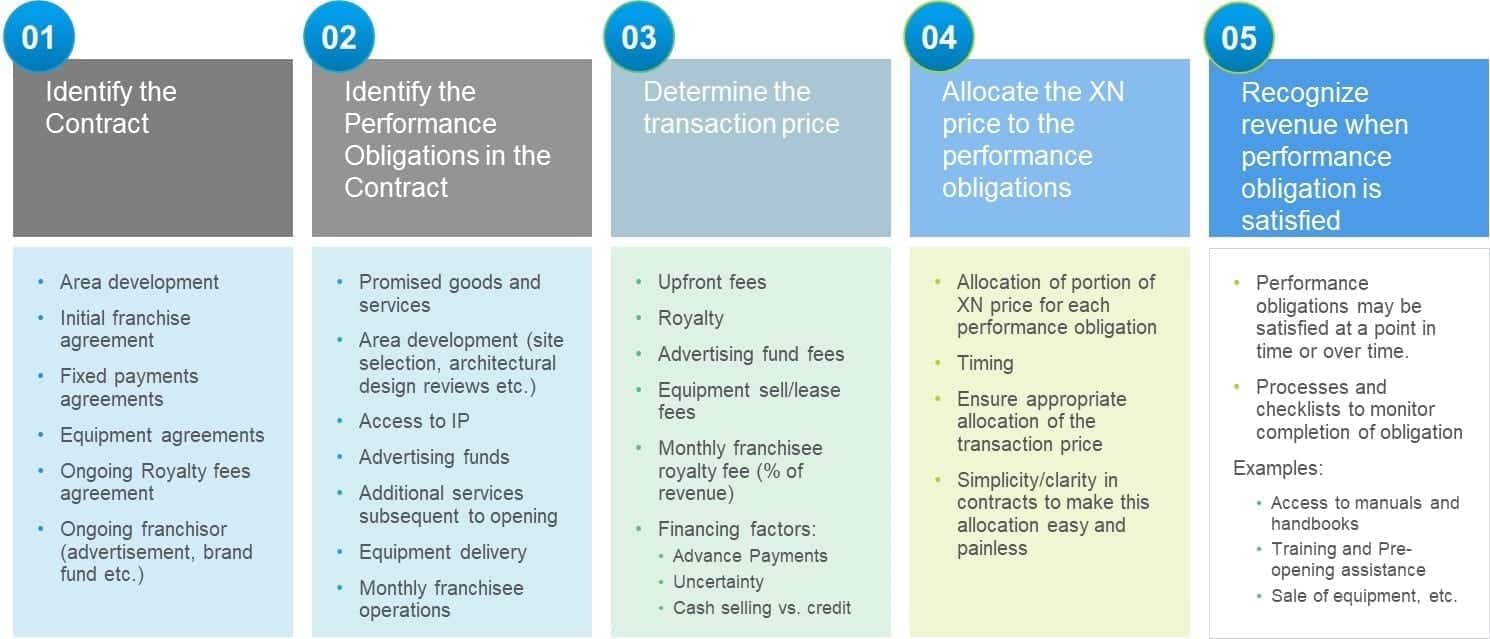

The 5 Steps in the Revenue Recognition Process – with the Food Service Industry as an Example

There are five general steps in the revenue recognition process. Companies must clearly identify the services and products they sell, contracts under which they sell, and implement accounting processes to properly and accurately capture revenue when the commitments as outlined in contracts are completed.

Because Smartbridge is well versed in business systems for large restaurant chains, we will use the food service industry as an example to walk through the rest of this. Of course, these principals apply to any organization, with minor modifications (such as franchisor-franchisee contracts).

An illustration of this concept and process for a typical food franchiser is outlined below as an example.

In the dynamic industry of food service, ethical and efficient accounting method of recognition revenue is especially important. The variety of franchisor-franchisee contracts, with the various moving parts and obligations in them require companies to implement standardized and documented processes, proper managerial governance, and technology (IT) partnerships to accurately recognize revenue at the right time.

Technology is only part of the solution, especially within contractual commitments established in the food service industry. A holistic approach must be taken towards the people, processes and technology aspects that drive the franchise. This involves establishing a cross functional implementation team, guidelines and checklists, and finally, choosing the right tool that will facilitate the revenue recognition implementation.

Implementing Revenue Recognition

Implementing revenue recognition involves specific integrations within internal controls and taxes:

Revenue recognition ensures not only ethical financial performance tracking, but also helps retain long term business relationships. IT innovation and digital enablement is especially important to adopt so the processes for proper revenue recognition upon completion of contract commitments can be automated where possible.

Several of the leading ERP vendors such as Oracle and SAP have taken the necessary steps to support the new revenue recognition standard. Oracle’s JD Edwards supports the new standard in various services such as contract billing, service billing, project costing, goods shipment etc. by setting up various triggers and schedules.

…are all basic ingredients for companies to propel themselves ahead of the competition, even when dealing with regulatory matters such as this.

Looking for more on digital innovation for the restaurant industry?

Explore more insights and expertise at Smartbridge.com/restaurant

There’s more to explore at Smartbridge.com!

Sign up to be notified when we publish articles, news, videos and more!

Other ways to

follow us: