Revenue Recognitionfor JD Edwards

Overview

Financial standards outline when you can recognize revenue for the exact amounts you bill to customers. FASB/IASB requirements state that you cannot recognize revenue for billed amounts, or cost of goods sold amounts, until a performance obligation to that customer has been fully satisfied.

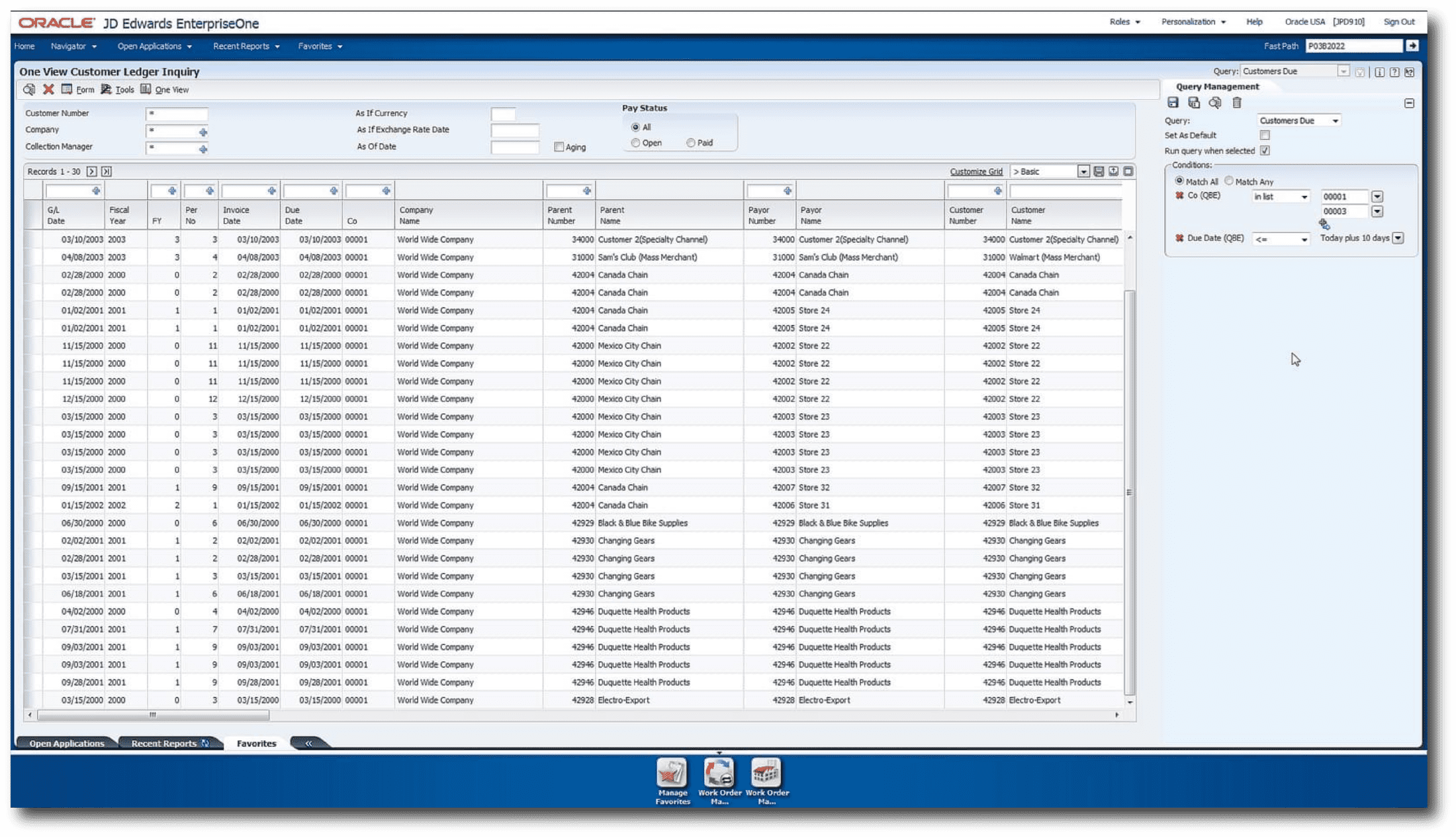

Since performance obligations can be satisfied in different ways and times (depending on the industry and service provided), keeping track of revenue and profit recognition can encompass various moving parts. Within the user community, Oracle JD Edwards can help your organization remain in compliance with these requirements.

Revenue Recognition for JD Edwards

Revenue recognition is invoice driven. This means any module within JD Edwards that initiates an invoice can be susceptible to the revenue recognition process. Profit recognition is based on the job itself, and the cost of said job, with drivers reliant on the job master. The modules that “feed into” either process, with the exception of initial setup, remain visually untouched and susceptible to falling out of FASB/IASB requirements.

Within JD Edwards, here are the modules/functions that are more at risk:

We can assist with revenue recognition setup requirements

In the past within the JD Edwards platform, revenue was recognized at the time the invoice was created, and therefore out of compliance. This can be a problem for organizations who haven’t taken the steps to make the proper updates within their platform (especially for those operating on versions 9.1 and older). Smartbridge has extensive experience in doing so for enterprise-level organizations, and can prevent your organization from falling victim to various liabilities.

See how we helped a global pharmaceutical provider remain within FASB/IASB requirements:

Implementing Revenue Recognition

Implementing revenue recognition involves specific integrations within internal controls and taxes:

You need a partner that can do it all

For all things JD Edwards, we can provide assistance to move your digital agenda forward. Start your journey or explore our library of JDE insights! Contact us today to learn more about our Oracle Cloud for JD Edwards.